Top 100 beauties in the world!

Top 100 beauties in the world!

Gallery: Who is the most beautiful one?

Gallery: Who is the most beautiful one?

If you like autumn, put your hands in the air!

If you like autumn, put your hands in the air!

Fan Bingbing's "Queen style" in new play

Fan Bingbing's "Queen style" in new play

Lingerie show at 2014 Miss China

Lingerie show at 2014 Miss China

J-10 fighters show aerobatic stunts in smog-free sky

J-10 fighters show aerobatic stunts in smog-free sky

Charming contestants of Shanghai Int’l Model Contest

Charming contestants of Shanghai Int’l Model Contest

Most amazing chi-pao beauties

Most amazing chi-pao beauties

7 deadly animal attacks

Russia to launch 70 Proton rockets by 2020: official

7 deadly animal attacks

Russia to launch 70 Proton rockets by 2020: officialEditor's Note:

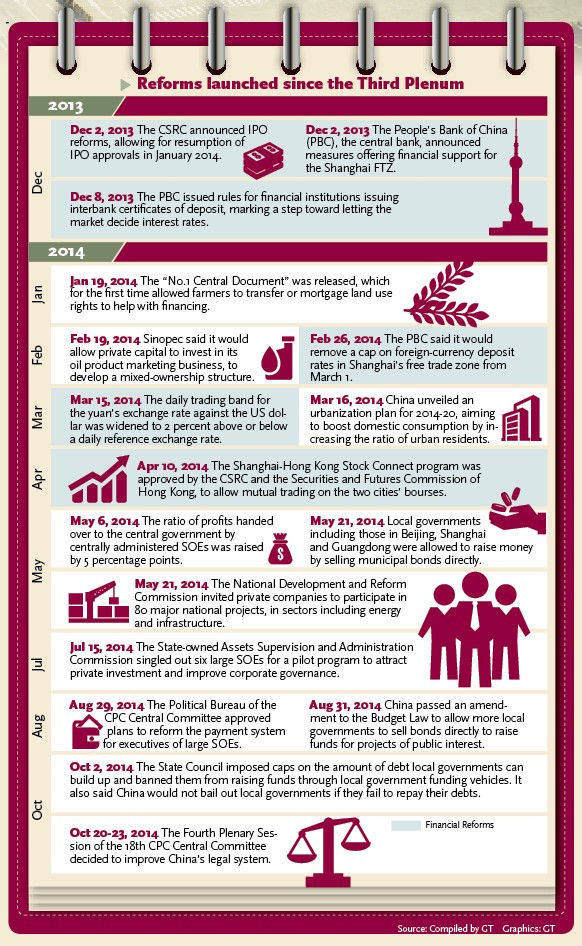

Over the past year, China's top leadership has been trying to move the economy toward a more sustainable path, with a slew of reforms announced at the Third Plenary Session of the 18th Communist Party of China (CPC) Central Committee in November 2013. The recently concluded Fourth Plenary Session of the 18th CPC Central Committee proposed reinforcing legislation in key areas and speeding up improvements to the legal system to reflect equal rights, opportunities and fair rules, all heralding a new chapter in the development of the Chinese legal system. Amid short-term difficulties caused by structural adjustment and the "new norm" of slower economic growth, China is set to harvest the fruits from local fiscal and taxation reform and mixed-ownership reform of State-owned enterprises (SOEs), as well as financial and stock reforms. The Global Times will dedicate three issues from Tuesday to examining the impact of the reforms in transforming China. The following focuses on the financial reforms unveiled in the past year.

In China's reform blueprint unveiled in November 2013 following the Third Plenum, one priority was to build a multi-layered financial market that would be further opened up, so as to allow the market to play a more decisive role in resource allocation and provide better financial support for the economy.

Among the major reform targets are opening-up of the country's banking sector to private capital, pushing forward IPO reform, and speeding up interest rate liberalization and convertibility of the yuan under the capital account.

"China has made periodical achievements in terms of financial reform since the release of the road map," Xu Hongcai, director of the Department of Information at the China Center for International Economic Exchanges, a government think tank, told the Global Times on Monday.

In an effort to make the yuan more convertible under the capital account, the country's central bank announced in March that it would double the yuan's daily trading band against the US dollar to 2 percent, up from 1 percent previously.

On top of that, the China Securities Regulatory Commission (CSRC), the country's securities watchdog, published guidelines in late 2013 to revamp the IPO system, vowing to give more leeway for market forces to play their part.

In terms of financial product innovation, the China (Shanghai) Pilot Free Trade Zone (FTZ) is serving as a pioneer and testing ground for financial reform, Xu said.

The FTZ, which was established in September 2013, started a pilot program in March involving interest rate liberalization for foreign currency deposits of less than $3 million within the zone.

China is expected to accelerate liberalization of its deposit rates in 2015 and set up a depository insurance scheme, Xu said.

Following the launch of the Shanghai-Hong Kong Stock Connect program, an international board for China's securities market is likely to be set up, which will allow foreign companies to get listed in Shanghai or Shenzhen to raise funds in yuan.

In return, this will greatly boost the globalization and convertibility of the yuan, Xu noted.

As for the yuan's internationalization, significant headway has been made in recent months, with a slew of currency swap agreements announced.

China's central bank signed a 35 billion yuan ($5.7 billion) currency swap deal on November 3 with its Qatari counterpart, which will make Qatar the first clearing hub in the Middle East for the Chinese currency.

Offshore yuan clearing and settlement services have also been set up in London, Frankfurt, Seoul, Paris, Luxembourg and Malaysia.

In a speech Monday at the Asia-Pacific Economic Cooperation (APEC) CEO Summit in Beijing, Russian President Vladimir Putin also said Russia and China intend to settle more trade in yuan.

China's interbank market has extended direct trading of the yuan with more major currencies this year, including the euro, sterling, the Australian dollar and the Singapore dollar.

In late September, the China Banking Regulatory Commission announced its approval of another two private banks, one in Shanghai and the other in East China's Zhejiang Province.

In July, it had given approval for three private banks - including Webank, funded by Chinese Internet giant Tencent - to be established.

Over the past year, reform of the yuan exchange rate regime, opening the banking sector to private investors and the Shanghai-Hong Kong Stock Connect scheme have been the major breakthroughs, said Chang Jian, chief China economist at Barclays Capital.

However, downward pressure on the economy and uncertainty in global financial markets are holding back China's efforts to accelerate its financial reform, Chang told the Global Times on Monday.

World Pole Dance Championship in China

World Pole Dance Championship in China In pics: PLA stages live-fire drill in NE China

In pics: PLA stages live-fire drill in NE China  59-year-old Liu Xiaoqing still looks stunning

59-year-old Liu Xiaoqing still looks stunning  Standard faces for each countries in the world

Standard faces for each countries in the world Shocking! Photos of Chinese fighters revealed

Shocking! Photos of Chinese fighters revealed Images of angels in white: At work v.s off work

Images of angels in white: At work v.s off work  Post-85s female pilots and their mission

Post-85s female pilots and their mission Netizens fall in love with champion swimmer Ning Zetao

Netizens fall in love with champion swimmer Ning Zetao Vibrant 21-year-old and her own Cheongsam brand

Vibrant 21-year-old and her own Cheongsam brand Top 10 most dangerous jobs in the world

Top 10 most dangerous jobs in the world  Top 10 fifth generation jet fighters in the world

Top 10 fifth generation jet fighters in the world Top 10 Chinese goddesses

Top 10 Chinese goddesses  Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 pure beauties in showbiz

Top 10 pure beauties in showbiz  Top 10 world's highest-paid models 2014

Top 10 world's highest-paid models 2014 The most gorgeous Chinese women

The most gorgeous Chinese women Top 10 most handsome faces in Asia

Top 10 most handsome faces in AsiaDay|Week|Month