BEIJING, July 8 -- Two major state-owned enterprises (SOEs) announced Wednesday night that their parent companies had followed the government encouragement and purchased more of their shares.

China's largest oil refiner, Sinopec Corp., said Sinopec Group bought 46 million of its Shanghai-listed shares on Wednesday, or 0.04 percent of its 121 billion shares, bringing its total holdings in its subsidiary to 71.3 percent.

Sinopec Group promised to buy a maximum of 2 percent of shares,including Wednesday's purchase, in the coming 12 months.

The China Securities Regulatory Commission (CSRC) on Wednesday encouraged major shareholders and senior managers to steady stock prices by buying more shares when prices fall sharply.

The stock market has taken a nose dive over the last month, with the Shanghai Composite Index shedding more than 30 percent.

The nation's top coal miner, Shenhua Energy Co. Ltd., said Shenhua Group bought 8.02 million shares listed in Shanghai, taking its holdings to 73.05 percent.

On the same day, Sinopec said in a filing with the Shanghai Stock Exchange that it expected its Q2 net profits to rise more than 10 fold compared with the previous quarter.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

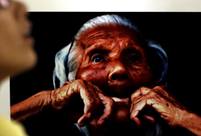

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week