BEIJING, July 10--China's top securities regulator said on Friday that it will continue with its approval procedures for initial public offerings (IPOs), though it confirmed that there will be no IPOs in the near term.

"There will be no IPOs in the near term, but we will continue with approval work for IPOs," said Deng Ge, spokesman for the China Securities Regulatory Commission (CSCR) on Friday.

The spokesman did not specify a period for the absence of IPOs on the market.

The agency will control the number of companies that seek to refinance through secondary offerings as well as the refinancing value, Deng said.

The official statement came after 28 companies announced on July 4 they will suspend their IPO plans amid sharp volatility in the stock market over the past several weeks.

The Shanghai index has lost about 28 percent of its value since a spectacular bull run ended with a peak of 5,178.19 points on June 12.

The government has stepped in with various measures to save the market, including pouring in funds and restricting futures trading on a major small-cap index.

China's key stock index staged a strong rebound for a second consecutive day on Friday on the back of the supportive measures, with the benchmark Shanghai Composite Index surging 4.54 percent to end at 3,877.8 points on Friday.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

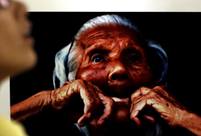

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week