BEIJING, May 26 -- The development of a non-performing loan (NPL) securitization market is credit positive because it will provide additional means for banks to dispose of their NPLs, global rating agency Moody's predicted on Thursday.

China Merchants Bank Co. Ltd. and Bank of China Limited last Thursday announced their first-ever proposed securitization of NPLs, which would be issued by the end of May and would be China's first NPL securitization since 2008.

Securitization allows banks to divest a wide range of NPLs, ranging from granular consumer finance portfolios to concentrated corporate loan portfolios.

Securitization provides flexibility and liquidity for banks to remove their NPLs, especially retail NPLs. Existing regulations ban financial institutions from selling their retail NPLs to distressed asset management companies, but there are no such restrictions on securitizing these NPLs, according to Moody's.

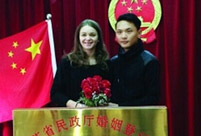

French girl ties the knot with Chinese boy

French girl ties the knot with Chinese boy Beijing Style: ready for bare legs

Beijing Style: ready for bare legs Century-old station sees railyway evolution

Century-old station sees railyway evolution Enthusiasts perform Kung Fu at Wudang Mountain

Enthusiasts perform Kung Fu at Wudang Mountain Stunning photos of China's fighter jets in drill

Stunning photos of China's fighter jets in drill Monk's mummified body to be made into a gold Buddha statue

Monk's mummified body to be made into a gold Buddha statue Former Chinese solider of the French Foreign Legion seeks wife online

Former Chinese solider of the French Foreign Legion seeks wife online Asia's longest and highest suspension bridge to open to traffic

Asia's longest and highest suspension bridge to open to traffic China's first interactive robot looks like a beauty

China's first interactive robot looks like a beauty Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Tech firms seen leaving Shenzhen

Tech firms seen leaving Shenzhen Diplomats should avoid public opinion spotlight

Diplomats should avoid public opinion spotlight Authorities urged to take action on fake universities that continue to proliferate

Authorities urged to take action on fake universities that continue to proliferate Refugees from Vietnam and their offspring grapple with lack of citizenship after more than three decades

Refugees from Vietnam and their offspring grapple with lack of citizenship after more than three decadesDay|Week