|

| (File photo) |

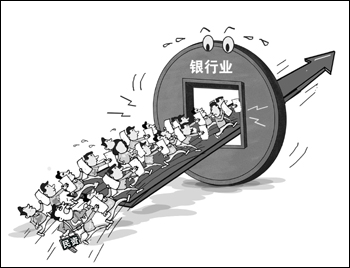

The China Banking Regulatory Commission (CBRC) issued a directive on boosting the development of private banks in recent days. In order to improve the efficiency of the application process, China's bank watchdog would inform applicants of the results within four months, though the legal time limit for such processes is six months.

For the time being, more than 40 domestic private enterprises have applied for starting private banks, said CBRC chairman Shang Fulin at a State Council news briefing.

Most of the shareholders of the private banks are big private enterprises with market experience which might have a better knowledge of upstream and downstream firms, small businesses, farmers, rural areas and agriculture. Then, private banks possibly tap effective demand for credit against financing bottlenecks in the real economy.

Webank, Mybank and other Internet banks are newcomers to the Chinese banking industry, which challenge the traditional regulations of the bank watchdog. The larger significance of the existence of private banks lies in the possibility that they might pose a catfish effect on the governance environment of all the Chinese banks and help enhance the whole regulatory system.

4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing PLA soldiers launch guided missiles in confrontation exercise

PLA soldiers launch guided missiles in confrontation exercise One woman’s fight against dog eaters

One woman’s fight against dog eaters Beautiful and smart - post-90s college teacher goes viral

Beautiful and smart - post-90s college teacher goes viral Top 10 luxury houses in the world

Top 10 luxury houses in the world  National Geographic: best photos during journey

National Geographic: best photos during journey Couples who engage in meaningful and deep conversations are happier

Couples who engage in meaningful and deep conversations are happier Maldives resort rated best hotel of 2015

Maldives resort rated best hotel of 2015  Gay marriage ruling will leave deep legacy

Gay marriage ruling will leave deep legacy Chinese Premier attends China-EU leaders' meeting

Chinese Premier attends China-EU leaders' meeting The road to tennis triumph

The road to tennis triumph New PLA campaign targets new recruits: Navy

New PLA campaign targets new recruits: NavyDay|Week