BEIJING, July 8 -- China's state asset regulator ordered the country's centrally administered state-owned enterprises (SOEs) not to sell shares in their listed companies amid the "abnormal market volatility", joining the concerted efforts to stem massive sell-offs in the stock market.

The State-owned Assets Supervision and Administration Commission also encouraged the SOEs to purchase more shares to stabilize prices.

The decision on Wednesday followed a raft of other supportive measures aimed at stemming the stock bloodshed that has seen the key Shanghai stock index plunge by more than 30 percent from its June peak, but the effort seemed to be of no avail so far.

In the previous trading days, China's institutional investors have spent a huge amount of money in share purchase of heavyweights such as Sinopec and PetroChina in an effort to restore market confidence, but the move only ended in a short-lived rally.

The benchmark Shanghai Composite Index sank 6.97 percent to open at 3,467.4, while the Shenzhen Component Index opened 4.44 percent lower at 10,870.14 on Wednesday.

Immediately after the market opening, the central bank issued a statement reiterating its liquidity support to stabilize the market and avoid systematic and regional financial risks.

China Securities Finance Corporation Limited, the national margin trading service provider, on Wednesday pledged to purchase more shares of small- and medium-sized listed companies to ease stock market liquidity.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

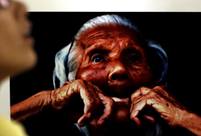

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Can China play a role in Greek debt crisis?

Can China play a role in Greek debt crisis?  Dogs in uniform: China’s combat canines

Dogs in uniform: China’s combat canines Cut for China

Cut for China Market reacts to govt support

Market reacts to govt support Day|Week