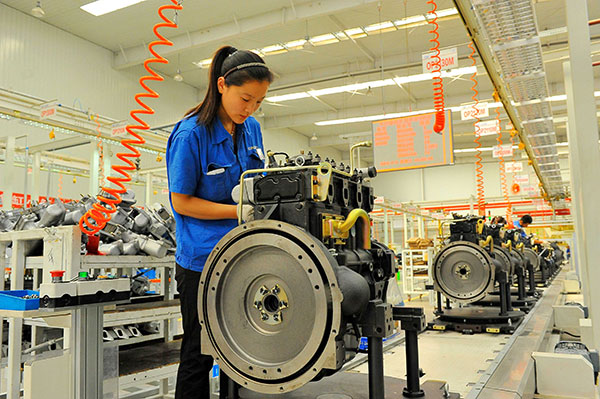

Workers assemble engines at a factory in Weifang, Shandong province. [Photo/China Daily]

China's industrial profits sharply declined by 4.6 percent year-on-year in October, widening the 0.1 percent drop in September, leading to a further delay in the economic rebound than expected and adding to the corporate debt default risk.

The sluggish data reported by the National Bureau of Statistics on Friday was mainly driven down by the energy-and commodity-intensive industries with problems of overcapacity, including oil, steel and coal.

But the high-tech manufacturing industry achieved 14.2 percent year-on-year profit growth. Profits in the equipment manufacturing industry increased by 8.6 percent, the NBS said.

In the first 10 months, the country's industrial profits shrank 2 percent from a year earlier, reaching a total of 4.87 trillion yuan ($785 billion).

Under the economic slowdown pressure, the sales revenue of industrial production dropped fast, while increased costs also squeezed net income, said He Ping, a senior economist at the bureau.

A series of economic indicators in October suggested that the world's second-largest economy has not yet seen any rebound after GDP hit a six-year low of 6.9 percent in the third quarter, although the government has made efforts to support growth through both monetary and fiscal measures.

On Friday, the onshore Chinese yuan's daily trading reference exchange rate slipped to 6. 3915 per US dollar, the lowest since Aug 20, influenced by expectations of depreciation in offshore markets amid the slowdown pressure.

Chen Kaiyang, a senior manager with the Bosera Asset Management, said: "Traditional industrial companies and small businesses will face greater challenges to survive during the economic restructuring process, plus the overall economy is continually slowing down."

Debt defaults may increase, especially at the year end when the financing market faces tightening liquidity, and investors should be aware of the potential systematic risk, said Chen.

According to a statement from Shanghai Clearing House, up to Nov 20, at least 43 companies had abandoned their plans to issue bonds that could raise a total of nearly 46.7 billion yuan. Most of those companies were from the steel and cement production industries.

The Chinamoney website, managed by the People's Bank of China, said that at least six companies have defaulted on yuan-denominated corporate bonds so far this year.

The website also showed that more Chinese companies are struggling to repay bonds including Jiangsu Lvling Runfa Chemical, a fertilizer maker, and Sichuan Shengda Group Ltd.

Contestants of Mrs. Globe pose for photo in Shenzhen

Contestants of Mrs. Globe pose for photo in Shenzhen

Bikini models attend hot pot banquet in Hefei

Bikini models attend hot pot banquet in Hefei J-10B fighters with homegrown engine in test fligh

J-10B fighters with homegrown engine in test fligh Photos of U.S. Navy intruding in South China Sea released

Photos of U.S. Navy intruding in South China Sea released Cats who immediately regretted their life choices in photographs

Cats who immediately regretted their life choices in photographs Beautiful girl from police college becomes Internet hit

Beautiful girl from police college becomes Internet hit 10 tons of copper coins unearthed in 2,000-yr old tomb

10 tons of copper coins unearthed in 2,000-yr old tomb In Pics: Amazing Chinese fighters

In Pics: Amazing Chinese fighters

Chinese, U.S. navies hold first-ever joint exercise in the Atlantic

Chinese, U.S. navies hold first-ever joint exercise in the Atlantic Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Sun seekers

Sun seekers Sex toy industry lacks govt oversight

Sex toy industry lacks govt oversight Military reform matches China’s evolution

Military reform matches China’s evolution Genetically engineered fish gets US FDA stamp of approval

Genetically engineered fish gets US FDA stamp of approvalDay|Week