BEIJING, April 14 -- China's central bank on Thursday pumped more money into the market to ease a liquidity strain.

The People's Bank of China (PBOC) conducted 40 billion yuan (6.2 billion U.S. dollars) of seven-day reverse repurchase agreements (repo), a process in which central banks purchase securities from banks with an agreement to resell them in the future.

The reverse repo was priced to yield 2.25 percent, unchanged from Wednesday's injection of 40 billion yuan, according to a PBOC statement.

The move followed a net injection of 60 billion yuan and 15 billion yuan into the financial system on Tuesday and Monday, respectively.

In Thursday's interbank market, the benchmark overnight Shanghai Interbank Offered Rate (Shibor), which measures the cost at which Chinese banks lend to one another, climbed by 3 basis points to 1.999 percent.

The evolution of J-10 fighter

The evolution of J-10 fighter Top 10 Asian beauties in 2016

Top 10 Asian beauties in 2016 Train rides through blossoms

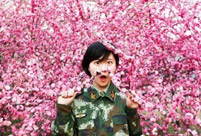

Train rides through blossoms When female soldiers meet flowers

When female soldiers meet flowers North Sea Fleet conducts drill in West Pacific Ocean

North Sea Fleet conducts drill in West Pacific Ocean Old photos record the change of Sichuan over a century

Old photos record the change of Sichuan over a century Breathtaking aerial photos of tulip blossoms in C China

Breathtaking aerial photos of tulip blossoms in C China Horrific: Pit swallows 25 tons of fish overnight

Horrific: Pit swallows 25 tons of fish overnight Police officers learn Wing Chun in E. China

Police officers learn Wing Chun in E. China Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Govt vows reform despite failure of tomb-removal campaign

Govt vows reform despite failure of tomb-removal campaign New Yorker writer’s Chinese food poem sparks racism ruckus

New Yorker writer’s Chinese food poem sparks racism ruckus Too much skin in Tibet Nude photos taken near sacred lake spark outcry

Too much skin in Tibet Nude photos taken near sacred lake spark outcry China strives to solidify authority over reincarnation of Tibetan Living Buddhas

China strives to solidify authority over reincarnation of Tibetan Living BuddhasDay|Week