BEIJING, June 6 -- China's central bank on Monday pumped more money into the market to ease a liquidity strain.

The People's Bank of China (PBOC) conducted 40 billion yuan (6.1 billion U.S. dollars) in seven-day reverse repurchase agreements (repo), a process in which central banks purchase securities from banks with an agreement to resell them in the future.

The reverse repo was priced to yield 2.25 percent, unchanged from Friday's injection of 40 billion yuan, according to a PBOC statement.

The move followed a net injection of 70 billion yuan and 95 billion yuan into the financial system on Thursday and Wednesday, respectively.

In Monday's interbank market, the benchmark overnight Shanghai Interbank Offered Rate (Shibor), which measures the cost at which Chinese banks lend to one another, dropped by 0.1 basis point to 1.998 percent after the injection.

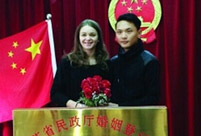

French girl ties the knot with Chinese boy

French girl ties the knot with Chinese boy Beijing Style: Hot pants

Beijing Style: Hot pants Century-old station sees railyway evolution

Century-old station sees railyway evolution Enthusiasts perform Kung Fu at Wudang Mountain

Enthusiasts perform Kung Fu at Wudang Mountain Students take stylish bikini graduations photos

Students take stylish bikini graduations photos Charming dancing students pose for graduation photos

Charming dancing students pose for graduation photos China opens its first combined transport service to Nepal

China opens its first combined transport service to Nepal Naked models transformed into landscapes, birds and even DRAGONS by body painting artist

Naked models transformed into landscapes, birds and even DRAGONS by body painting artist China's first interactive robot looks like a beauty

China's first interactive robot looks like a beauty Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Citizens of the world

Citizens of the world Gaokao?cheaters to face criminal charges

Gaokao?cheaters to face criminal charges ‘No fear of trouble’ in S.China Sea top PLA official

‘No fear of trouble’ in S.China Sea top PLA official New Chinese TV series breaks nation’s silence on the Korean War

New Chinese TV series breaks nation’s silence on the Korean WarDay|Week