Happy life in Xinjiang

Happy life in Xinjiang

2014 China Hainan Int'l Automotive Exhibition kicks off

2014 China Hainan Int'l Automotive Exhibition kicks off

Collection of 'China Dream' public-spirited ads

Collection of 'China Dream' public-spirited ads

The silent holy stones

The silent holy stones

University students take care of giant pandas

University students take care of giant pandas

Leading lady a true legend

Leading lady a true legend

China Pan-Asia Stone Expo held in Kunming

China Pan-Asia Stone Expo held in Kunming

Taiwan woman marries into Kazak family, 100 sheep plus a flat as dowry

Taiwan woman marries into Kazak family, 100 sheep plus a flat as dowry

College girls take graduation photos under water in Chongqing

College girls take graduation photos under water in Chongqing

Cartoon: Xi and football

Cartoon: Xi and football

|

| (Graphics: GT) |

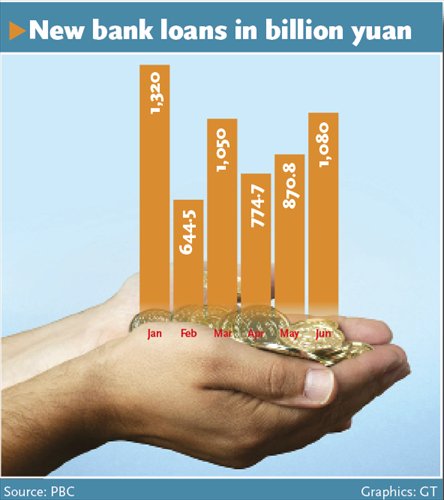

China's new lending growth surpassed market expectations in June, when broad money supply hit a 10-month high, according to official data on Tuesday, mirroring the country's ratcheted up efforts to spur the world's second-largest economy.

Chinese banks extended new loans of 1.08 trillion yuan ($176 billion) in June, the highest amount since January and an increase of 25.5 percent year-on-year, the People's Bank of China (PBC), the central bank, said in a statement on Tuesday.

Meanwhile, broad M2 money supply surged 14.7 percent from a year earlier, the largest growth since August 2013, and higher than the official pre-set annual target of 13 percent.

Total social financing (TSF) aggregate, a broad measure of liquidity including traditional loans, stocks, bonds and off-balance-sheet lending, was 1.97 trillion yuan in June compared with 1.4 trillion yuan the month before.

It shows continued monetary and credit easing by the PBC, through widely documented targeted re-lending and deposit reserve requirement ratio (RRR) cuts to banks, Chang Jian, chief China economist at Barclays Capital, told the Global Times on Tuesday.

"An abundant liquidity will continue in the second half of the year, and the central bank is expected to take more measures to wean off the downward pressure on the economy," she said.

China's economy is still facing uncertainties and especially challenges of sliding property market and lingering issue of overcapacity. The existing pro-growth measures are not enough though they are actually beyond so-called mini-stimulus measures, Chang said.

The State Council, China's cabinet, launched in April a raft of measures including speeding up railway construction and tax breaks for small firms. The central bank also encouraged city commercial banks and rural financial institutions to lend more by lowering their deposit requirements twice in order to strengthen financial support to small firms and agricultural development.

Higher-than-expected M2 and total social financing aggregate were mainly due to the low base in June 2013 when a tight liquidity led to a cash crunch, Xu Gao, chief economist of Everbright Securities, said in a research note sent to the Global Times on Tuesday.

New credit is estimated to be about 10 trillion yuan for this year, Xu estimated, noting, however, the policymakers will be less likely to tolerate the growth of TSF driven by off-balance-sheet lending.

Fast credit expansion was also due to an improvement in the manufacturing and services sectors which increased demand for financing, E Yongjian, an analyst at Bank of Communications, said in a research note on Tuesday.

According to E, monetary policy is expected to be steady in the second half of the year, and targeted financial support and structural credit easing will be the main theme.

An overall RRR cut will boost cash supply but will undermine the efforts on economic restructuring, as money will continue to flow into high-return yet risky property and local government financing vehicles, E noted.

Sheng Songcheng, head of statistics at the PBC, was quoted by stock portal aastock.com as saying on Tuesday at an internal meeting that the June financial data showed significant improvement in the credit structure.

New loans grew faster in the country's western region than in the central and eastern regions, and mid- to long-term corporate loans accelerated and greatly supported the fixed-assets investment in the manufacturing and services sectors, Sheng said.

More credit went to support micro- and small-sized enterprises rather than larger corporations, loans to finance agricultural sector increased, while credit to industries plagued by overcapacity especially steel and construction materials fell, he remarked.

Moms on their kid’s coming out

Moms on their kid’s coming out Chinese fighters through lens

Chinese fighters through lens

Children attend gymnastics training in summer

Children attend gymnastics training in summer

Beautiful sceneries along the special travel route in Xinjiang

Beautiful sceneries along the special travel route in Xinjiang

Beauty SWAT member in Xinjiang sparks online frenzy

Beauty SWAT member in Xinjiang sparks online frenzy

Germany beat Argentina 1-0 to win World Cup

Germany beat Argentina 1-0 to win World Cup

National fitness team members integrate traditional and modern beauty

National fitness team members integrate traditional and modern beauty Collection of 'China Dream' public-spirited ads

Collection of 'China Dream' public-spirited ads  How Chinese men kill the time when their wives practice square dancing?

How Chinese men kill the time when their wives practice square dancing? China's largest 3D printer builds 2-meter-long boat

China's largest 3D printer builds 2-meter-long boat

One-legged women with high heel goes viral on Internet

One-legged women with high heel goes viral on Internet Photos of the Week

(July 6 - July 12)

Photos of the Week

(July 6 - July 12)

'Super moon' seen in Beijing

'Super moon' seen in Beijing

Happy life in Xinjiang

Happy life in Xinjiang

'Finding Nemo' in Seattle Aquarium

'Finding Nemo' in Seattle AquariumDay|Week|Month