|

| View of the headquarters and head office of the Peoples Bank of China (PBOC), Chinas central bank, in Beijing, China. (Photo/Xinhua) |

BEIJING -- The People's Bank of China (PBOC), China's central bank, extended a 6-month medium-term lending facility (MLF) worth 250 billion yuan (over $40 billion) at an interest rate of 3.35 percent to 11 banks on Friday.

The extension means the capital will remain in the money market while a total of 384.5 billion yuan worth of MLF in 14 financial institutions came due on the day.

The PBOC said the move was to meet the banks' capital need and maintain the liquidity in banking system at a sufficient level, aswell as encourage banks to increase support to key sectors and weak points of the economy.

The MLF is one of the fresh liquidity tools the central bank invented in 2014 to help commercial and policy banks maintain liquidity.

On Thursday, the PBOC conducted 35 billion yuan worth of 7-day reverse repos at a yield of 2.5 percent to inject liquidity into the market.

Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Hong Kong in lens

Hong Kong in lens Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

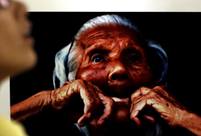

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing Conspiracy theories can’t explain stock falls

Conspiracy theories can’t explain stock falls Gay marriage in China: One couple's story

Gay marriage in China: One couple's story South China urged to upgrade fast

South China urged to upgrade fast CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for Tokyo

CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for TokyoDay|Week