BEIJING, July 5 -- The recent correction of Chinese shares could pave the way for the A-share market to become more rational, while authorities still have more tools to stabilize the market, HSBC said on Sunday.

It is surprising to see how quickly the A-share market has reversed its upward trend and volatility has spiked up. The benchmark Shanghai Composite Index has tumbled by 29 percent in three weeks, including a 12-percent loss this week, the banking giant said in its latest research note.

"We highlighted ballooning margin trading and leverage on A-shares a month ago," it said.

The recent tumult was a "perfect storm" for Chinese investors to learn about risk and reward as well as value-oriented investment approach despite the fact that all market participants have suffered from the sell-off, the bank said.

The Chinese stock market experienced a slump over past weeks, and a raft of measures has been rolled out to stabilize the market, with 28 companies that were given permission from the securities watchdog for initial public offerings (IPOs) announcing Saturday evening they would postpone follow-up issue of shares due to recent market fluctuations.

"The regulator still has more options to stabilize the market, and its latest probe into short selling in the futures market highlights its commitment in restoring market confidence," it stressed.

Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

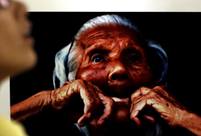

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Hong Kong in lens

Hong Kong in lens Conspiracy theories can’t explain stock falls

Conspiracy theories can’t explain stock falls Gay marriage in China: One couple's story

Gay marriage in China: One couple's story South China urged to upgrade fast

South China urged to upgrade fast CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for Tokyo

CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for TokyoDay|Week