BEIJING, July 10 -- Nearly a quarter of China's listed companies have come up with plans to stabilize their stock prices, the country's securities regulator said on Friday.

As of Thursday, 655 companies had announced measures to increase share holding of or repurchase their own stocks from the market, after a period in which the market plunged by 30 percent from its June 12 peak, according to the China Securities Regulatory Commission (CSRC).

On Wednesday, the CSRC encouraged major shareholders, directors, supervisors and senior managers of listed companies to buy more shares to help maintain steady prices.

Thanks to the government's propping up of the market, Chinese shares have staged a two-day rebound, with the benchmark Shanghai Composite Index leaping 4.54 percent to finish at 3,877.8 points on Friday.

Top 10 summer resorts across China

Top 10 summer resorts across China Campus belle in HK goes viral online

Campus belle in HK goes viral online Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

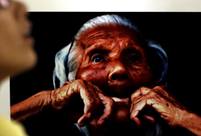

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Promote reform as stock market stabilizes

Promote reform as stock market stabilizes Taking stock: the ups and downs of Chinese shareholders

Taking stock: the ups and downs of Chinese shareholders Small rise in CPI shows growth still slack: experts

Small rise in CPI shows growth still slack: experts Donations struggle to grow after China stops getting organs from executed prisoners

Donations struggle to grow after China stops getting organs from executed prisonersDay|Week