BEIJING, May 16 -- China's central bank on Monday pumped 25 billion yuan (3.8 billion U.S. dollars) into the market to preserve liquidity.

The People's Bank of China (PBOC) put 45 billion yuan into seven-day reverse repos, a process by which central banks purchase securities from banks with an agreement to sell them back in the future.

The reverse repo was priced to yield 2.25 percent, according to a PBOC statement.

Reverse repos worth 20 billion yuan mature on Monday, so the central bank has effectively injected 25 billion yuan into the market.

On Monday's interbank market, the benchmark overnight Shanghai Interbank Offered Rate (Shibor) was up by 0.3 basis point to 2.005 percent.

The Shibor for seven-day loans also increased 0.3 basis point to 2.327 percent. The Shibor for three-month loans rose 0.4 basis point to 2.9075percent.

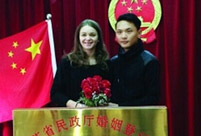

French girl ties the knot with Chinese boy

French girl ties the knot with Chinese boy Beijing Style: ready for bare legs

Beijing Style: ready for bare legs Century-old station sees railyway evolution

Century-old station sees railyway evolution Enthusiasts perform Kung Fu at Wudang Mountain

Enthusiasts perform Kung Fu at Wudang Mountain Stunning photos of China's fighter jets in drill

Stunning photos of China's fighter jets in drill Monk's mummified body to be made into a gold Buddha statue

Monk's mummified body to be made into a gold Buddha statue Former Chinese solider of the French Foreign Legion seeks wife online

Former Chinese solider of the French Foreign Legion seeks wife online Asia's longest and highest suspension bridge to open to traffic

Asia's longest and highest suspension bridge to open to traffic China's first interactive robot looks like a beauty

China's first interactive robot looks like a beauty Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Rousseff’s suspension won’t cure ailing Brazil

Rousseff’s suspension won’t cure ailing Brazil  Reforms, consumption set to boost growth

Reforms, consumption set to boost growth  As police crack down again on sex work, some say legalization is solution

As police crack down again on sex work, some say legalization is solution China recognizes ‘good netizens’ who spread ‘positive energy’

China recognizes ‘good netizens’ who spread ‘positive energy’ Day|Week