BEIJING, April 22 -- China's central bank has pumped 870 billion yuan (around 133.8 billion U.S. dollars) into the market this week to ease a cash strain at a time when previous liquidity tools are maturing and companies are facing peak tax payments.

The People's Bank of China (PBOC) on Friday conducted 240 billion yuan of seven-day reverse repurchase agreements (repo), a process in which central banks buy securities from banks with an agreement to resell them in the future.

The operation followed a 250-billion-yuan reverse repo on Wednesday and one of 260 billion yuan on Thursday. With other liquidity tools maturing, the total net injection was 680 billion yuan this week.

That was just under a weekly record of 690 billion yuan seen in January and sharply up from a net injection of 70 billion yuan last week.

The reverse repo on Friday was priced to yield 2.25 percent, unchanged from Thursday, according to a PBOC statement.

The injection was taken as the central bank's earlier medium-term lending facility (MLF) operations, reaching billions of yuan, come to mature this month.

MLF is a tool introduced in 2014 to help commercial and policy banks maintain liquidity by allowing them to borrow from the central bank by using securities as collateral.

In Friday's interbank market, the benchmark overnight Shanghai Interbank Offered Rate (Shibor), which measures the cost at which Chinese banks lend to one another, climbed by 0.9 basis point to 2.038 percent.

The evolution of J-10 fighter

The evolution of J-10 fighter Top 10 Asian beauties in 2016

Top 10 Asian beauties in 2016 What's happening in Xisha Islands?

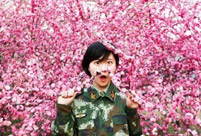

What's happening in Xisha Islands? When female soldiers meet flowers

When female soldiers meet flowers North Sea Fleet conducts drill in West Pacific Ocean

North Sea Fleet conducts drill in West Pacific Ocean Old photos record the change of Sichuan over a century

Old photos record the change of Sichuan over a century Breathtaking aerial photos of tulip blossoms in C China

Breathtaking aerial photos of tulip blossoms in C China Horrific: Pit swallows 25 tons of fish overnight

Horrific: Pit swallows 25 tons of fish overnight Vietnamese Su-30 fighters fly over Nanwei Island in South China Sea

Vietnamese Su-30 fighters fly over Nanwei Island in South China Sea Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads When can a fan call it quits

When can a fan call it quits Expats aim for the silver screen

Expats aim for the silver screen Press freedom index hides absurd logic

Press freedom index hides absurd logic Toxic campus scandal tests govt ability to build public trust

Toxic campus scandal tests govt ability to build public trustDay|Week