BEIJING, June 7 -- The central bank pumped 208 billion yuan (about 32 billion U.S. dollars) into the financial system on Tuesday in open market operations via medium-term lending facility(MLF).

The MLF tool was first introduced in 2014 to help commercial and policy banks maintain liquidity by allowing them to borrow from the central bank by using securities as collateral.

The fresh funds were injected into 14 financial institutions, according to the People's Bank of China (PBOC).

A total of 123.2 billion yuan is for three-month MLF, 11.5 billion yuan is for six-month MLF, and 73.3 billion yuan is for one-year MLF, at interest rates of 2.75 percent, 2.85 percent and 3 percent, respectively.

The interest rates were left unchanged to "guide financial institutions to boost support for key areas and vulnerable links in the national economy," the central bank said.

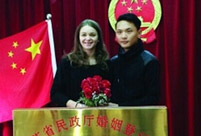

French girl ties the knot with Chinese boy

French girl ties the knot with Chinese boy Beijing Style: Hot pants

Beijing Style: Hot pants Century-old station sees railyway evolution

Century-old station sees railyway evolution Enthusiasts perform Kung Fu at Wudang Mountain

Enthusiasts perform Kung Fu at Wudang Mountain Students take stylish bikini graduations photos

Students take stylish bikini graduations photos Charming dancing students pose for graduation photos

Charming dancing students pose for graduation photos China opens its first combined transport service to Nepal

China opens its first combined transport service to Nepal Naked models transformed into landscapes, birds and even DRAGONS by body painting artist

Naked models transformed into landscapes, birds and even DRAGONS by body painting artist China's first interactive robot looks like a beauty

China's first interactive robot looks like a beauty Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Mainland market power sways Lanc?me

Mainland market power sways Lanc?me China encourages commercialization of museums

China encourages commercialization of museums Beijing parents protest against ‘favorable treatment’ of ethnic students in gaokao

Beijing parents protest against ‘favorable treatment’ of ethnic students in gaokao  Young Chinese are finding a new way of paying tribute to their favorite stars charity

Young Chinese are finding a new way of paying tribute to their favorite stars charityDay|Week